Need fast cash solutions? You’re not alone. Many people experience unexpected expenses and need quick financial solutions to help them get back on track.

Same-day loans offer a convenient way to access money when you need it the most. These loans vary in type, each designed to meet different needs, so it’s important to understand your options before completing the application process.

In this article, we’ll guide you through the entire journey of obtaining a same day loan. We’ll highlight the easy approval process and the necessary steps to secure funding quickly. Let’s explore how you can confidently and clearly navigate the world of fast cash solutions.

Understanding same day loans

Same day loans are a type of short-term, high-interest financial solution designed to provide fast cash during emergencies. They are popular due to their convenient loan process.

Here’s how it works:

Application process

Apply online for quick access to cash. You’ll need basic information like your source of income, proof of income, and (sometimes) your credit score.

Approval

After a quick credit check, the payday lender evaluates your application. Many same-day loans promise easy approval even if you have bad credit.

Funding

Once approved, funds are typically deposited into your account on the same day, making them ideal for a financial emergency.

Comparison Table: Traditional Loans vs. Same-Day Loans

| Aspect | Traditional Loans | Same-Day Loans |

| Speed | Slow (Days to Weeks) | Fast (Same day) |

| Credit Check | Strict | Flexible |

| Interest Rates | Lower | Higher |

| Repayment Period | Longer | Shorter |

| Financial Emergency Use | Not Ideal | Ideal |

Types of same-day loans

Different types of same-day loans are available, each tailored to fit unique financial needs. Understanding these options will help you choose the most convenient loan process for your situation. The primary types of same-day loans include personal, payday, and installment loans.

Personal loans

Personal loans are a useful financial solution when you require quick access to cash. These loans are usually offered by online lenders or sometimes through your local credit union.

The application process for personal loans is straightforward and designed to ensure easy approval, particularly when you have a stable source of income.

Loan interest rates and terms

Personal loans typically have more competitive interest rates than payday loans, though they might involve a basic credit check. They also provide longer repayment periods, making it easier to manage your monthly budget.

Uses

Use personal loans to cover unexpected expenses or attend to a financial emergency without exorbitant finance charges.

Requirements

Having proof of income and a good credit score will improve your chances of getting approval. However, some lenders may offer these loans even if you have bad credit.

Payday loans

Payday loans are one of the most popular same-day financial solutions. They are designed for those times when money is tight and you need fast cash solutions. These loans have a convenient loan process that caters to individuals with varying income levels.

Speed and approval

Payday lenders often provide access to cash rapidly, with funds available on the same day. There’s usually a quick credit check, and easy approval is common, even for those with bad credit.

Loan interest rates and risks

These loans typically have high interest rates, making them a short-term solution. If not managed carefully, they can lead to a cycle of debt.

Repayment

Generally, these loans are due on your next payday. Understanding the loan terms and ensuring you can meet the repayment obligations is essential.

Installment loans

Installment loans offer a balanced mix of fast cash solutions and manageable repayment options. They provide funds quickly.

Structure

With installment loans, you borrow a lump sum and repay it in fixed monthly installments over a specified period. This setup makes the repayment period more manageable and predictable.

Interest rates

While not as low as traditional personal loans, installment loans are more competitive than payday loans.

Financial assistance

These loans are ideal for larger financial needs and help spread out payments, reducing financial strain compared to payday loans.

Application process explained

Navigating the world of same-day loans is simple with the right guidance. Understanding the convenient loan process helps ease your concerns and set you on the right path to meeting your financial needs.

Steps to apply for a same-day loan

Applying for a same-day loan is straightforward and designed to be user-friendly. Let’s break down the steps:

Research payday lenders

Begin by researching payday lenders. Choose from a traditional payday lender, a credit union offering short-term loans, or an online lender. Ensure that the lender provides competitive interest rates that match your financial situation.

Verify eligibility

Check if you meet the basic eligibility requirements. Most lenders ask for a minimum age of 18, proof of income, and a checking account. Some may consider your credit score, but many same-day loans are available even with bad credit.

Gather necessary documents

Before applying, collect the necessary documents. This typically includes ID, proof of income, and bank account information. Having these ready speeds up the approval process.

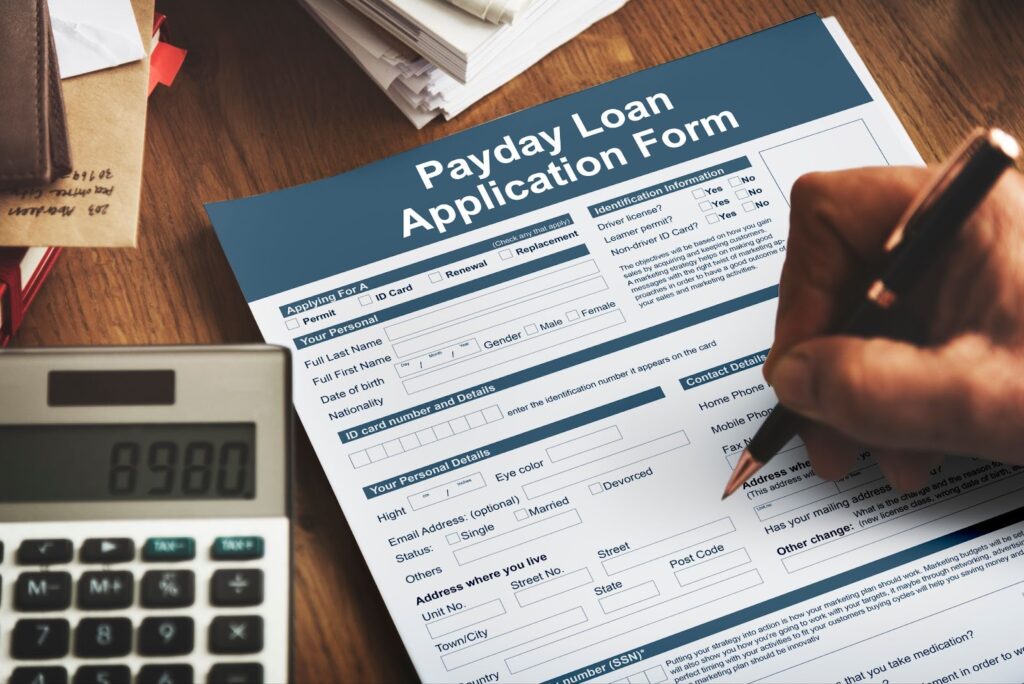

Fill out the application form

Whether online or in-person, fill out the loan application form. The form will ask for personal details and financial information. Be honest and accurate to avoid delays.

Submit the application

Submit your application. This is usually a quick process for online applications, but in-person applications might require a short wait for initial processing.

Receive a decision

Lenders will review your application once you’ve submitted it. Thanks to convenient loan processes, some can offer decisions within minutes. Others may take longer, especially if they require a more detailed credit check.

Review loan terms

If approved, you’ll receive your loan offer detailing the loan interest rates, finance charges, repayment period, and consumer protections. Read this carefully to understand your obligations.

Accept the loan

If you agree to the loan terms, accept them. Money is often sent to your bank account quickly, sometimes on the same day, making same-day loans easy approval a reality.

Documents required for application

To apply for a same-day loan, you must provide certain documents. These help the lender assess your application and decide to offer you fast cash solutions. Here’s a list of what you might need:

- Government-issued ID: Provides proof of identity and confirms you meet the age requirement (usually 18 years or older).

- Proof of income: This shows your source of income, which could be a paycheck, social security benefits, or other regular income. It reassures the lender of your ability to repay the loan.

- Bank account information: Most payday lenders require an active checking account for fund transfers and repayments.

- Contact information: This includes your phone number and email address so that we can reach you during the loan process and for any future communication.

- Residential details: Some lenders require proof of address, such as a utility bill, to verify your living situation.

Ensure all documents are current and accurate to make the process as smooth as possible. Having these ready before you start the application significantly enhances the convenience of the loan process, allowing you swift access to cash when needed.

Interest rates and fees

When considering getting a same-day loan, it’s important to understand the costs involved. Fast cash solutions are helpful, but they come with their own price. When looking at same-day loans, let’s dive into what interest rates and fees you might face.

Understanding APR

Annual Percentage Rate, or APR, is a term you need to know. APR tells you how much it will cost to borrow money over the course of a year. Same-day loans easy approval might sound great, but since these are short-term, high-interest loans, the APR can be quite high.

Even though the loan is only for a short time, the APR helps you see what you would pay if the loan lasted a whole year. So, when choosing a payday lender or online lender, check their APR. It can help you compare different loans and find one with competitive interest rates. Remember that the lower the APR, the less you pay in the long run.

Here’s a simple table to show how loan interest rates can affect what you pay back:

| Loan Amount | Interest Rate | Total Repayment |

| $100 | 10% | $110 |

| $100 | 20% | $120 |

| $100 | 30% | $130 |

This table only shows the interest rate for a single period, not the APR. But it gives you a basic idea of how higher rates mean paying more money back.

Other fees to watch for

- Finance charges: This is the fee for taking out the loan. It’s added to what you owe.

- Late payment fees: If you don’t repay the loan on time, you could be charged additional costs.

- Prepayment penalties: Some lenders charge you for paying the loan off early.

Staying informed about these fees will help you understand repayment terms and avoid a cycle of debt. Always read all the loan terms and conditions carefully before signing.

If you have any questions, don’t hesitate to ask the lender for clarification. They should be transparent and help you understand every part of the loan, ensuring you understand how it will impact your financial assistance needs.

By monitoring these aspects, you can confidently navigate same-day loans and ensure that you’re set up for financial success without unexpected surprises.

Repayment options

Short-term vs. long-term repayment

You need to understand your repayment period when considering same-day loans. Let’s break it down:

Short-term repayment

This typically lasts two weeks to a month. It’s ideal if you have a steady source of income and can handle high-interest loans quickly without disrupting your finances.

Long-term repayment

This option spreads payments over several months. It’s suitable if you prefer lower, manageable payments, but note that the finance charge might be higher due to a longer repayment period.

Here’s a simple table to illustrate the difference:

| Repayment Type | Duration | Pros | Cons |

| Short-term | 2 weeks – 1 month | Fast payoff, less interest over time | High payment amounts |

| Long-term | Several months | Lower monthly payments | Potential for more interest |

Fast cash solutions from USA Cash Services

Ready to navigate the process of obtaining a same day loan effortlessly? Trust USA Cash Services to guide you from application to approval with clarity and speed.

Whether you’re facing urgent financial needs or unexpected expenses, we’re here to help you secure the funds you need, when you need them. Visit USA Cash Services today to start your application and experience a smooth, hassle-free path to financial relief. Don’t wait — apply now and get approved the same day!